The U.S. trade deficit has long been viewed as an indicator of economic vulnerability. In 2022 alone, the country’s deficit in physical goods surpassed $945 billion, driven largely by imports of electronics, machinery, and consumer goods. Critics argue that this imbalance is evidence of declining manufacturing competitiveness. However, this analysis overlooks the monumental economic impact of the digital economy, where U.S. companies lead global markets. Technology giants like Apple, Google, Microsoft, Amazon, and Meta generate revenues far exceeding many countries’ GDPs, yet these contributions are often excluded from traditional trade metrics.

America’s exports aren’t just goods; they are ideas, innovation, and influence.

Satya Nadella, CEO of Microsoft

This article challenges the prevailing narrative by highlighting the dominance of U.S. tech companies, their global impact, and how digital exports offset physical trade deficits, painting a more accurate picture of American economic strength.

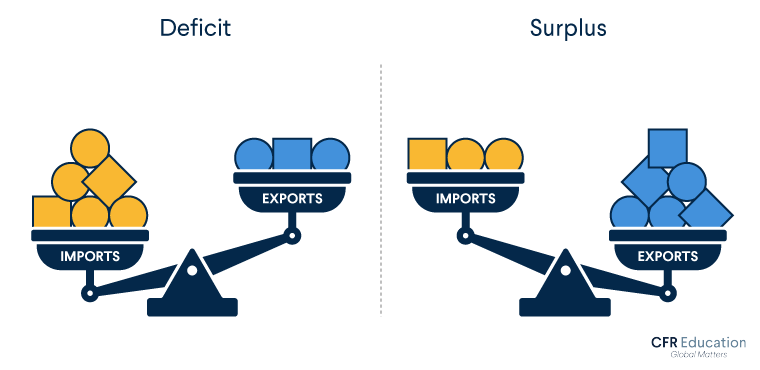

Understanding the Trade Deficit

Physical Goods: A Snapshot of U.S. Trade Deficit

The United States relies heavily on imported goods, with the largest trade deficits recorded in sectors such as consumer electronics, automobiles, and machinery. Key trade relationships in 2022 include:

- China: $536 billion in imports, contributing to a $382 billion deficit.

- Mexico: $455 billion in imports, leading to a $130 billion deficit.

- European Union: $452 billion in imports, with a deficit of $207 billion.

Exports, while robust in areas such as aerospace, agriculture, and pharmaceuticals, fail to bridge the gap. The $1.8 trillion in goods exported in 2022 is dwarfed by $2.8 trillion in imports. Traditional metrics suggest a grim picture, but they fail to account for the digital economy’s immense contributions.

Big Tech’s Role in Reshaping Global Commerce

Digital Revenue vs. Physical Trade

While physical goods generate a $1 trillion deficit, the U.S.’s digital economy thrives. A closer look at 2023 revenue figures reveals:

| Aspect | Value (2023) | Remarks |

|---|---|---|

| Physical Goods Deficit | $1 trillion | Resulting from imports of goods such as electronics and vehicles. |

| Digital Economy Revenue | Over $2 trillion | Driven by tech giants like Apple, Microsoft, Google, Amazon, and Meta. |

| Estimated Digital Surplus | $500 billion | Generated from software, cloud services, and digital advertising exported globally. |

This digital economy not only compensates for physical deficits but also positions the U.S. as a global leader in innovation and technology.

Dominance of U.S. Tech Giants

American technology companies have revolutionized global commerce and established monopolistic control across multiple sectors:

- Apple Inc.

- Revenue (2023): $394 billion, with 60% generated internationally.

- Market Control: Apple accounts for 90% of global smartphone profits despite owning only 20% of the market in unit sales. The App Store ecosystem alone generates $85 billion annually.

- Microsoft Corporation

- Revenue (2023): $232 billion.

- Global Influence: Microsoft products like Windows and Office dominate 77% of enterprise markets globally. Its Azure cloud platform is a key player in the $600 billion cloud computing sector.

- Amazon

- Revenue (2023): $524 billion.

- E-Commerce Leader: Amazon processes 40% of global online retail transactions, redefining retail and logistics with its $100 billion logistics network.

- Google (Alphabet Inc.)

- Revenue (2023): $280 billion.

- Digital Ads: Google captures 40% of the $500 billion global digital advertising market and dominates search engines with a 92% market share.

- Meta Platforms (Facebook, Instagram, WhatsApp)

- Revenue (2023): $117 billion.

- Social Media: Controls 70% of global social media traffic, serving over 3 billion active monthly users.

These companies generate revenues equivalent to or exceeding the GDPs of many developed nations, creating a global dependency on U.S. technology.

The Global Impact of U.S. Digital Supremacy

Dependency on U.S. Tech

- Enterprise Software: Over 1 billion devices worldwide rely on Microsoft products, cementing the company’s influence in corporate and government operations.

- Cloud Infrastructure: AWS, Microsoft Azure, and Google Cloud control over 60% of the global cloud computing market, powering essential infrastructure in 90+ countries.

- Data Dominance: U.S. firms lead in global data storage and management, owning the majority of high-capacity data centers.

We don’t just trade products; we trade progress through digital platforms.

Sundar Pichai, CEO of Google

Economic Consequences for Other Nations

- Trade Imbalances: Countries like India and the European Union import billions of dollars in digital services from U.S. companies without offsetting digital exports.

- Competition Suppression: Local startups struggle to compete against U.S. giants, as seen with Spotify (challenged by Apple Music) and Flipkart (outpaced by Amazon).

Environmental and Economic Efficiency

The digital economy provides economic and environmental advantages over physical goods manufacturing:

- Carbon Footprint Reduction: Cloud computing and digital services use significantly less energy than traditional industries. For example, Google’s data centers consume 50% less energy than the industry average.

- Dematerialization: Digital services replace physical products, such as books and DVDs, reducing waste and environmental degradation.

Policy Recommendations

To address misconceptions about the trade deficit and harness the potential of the digital economy, the U.S. should:

- Revise Trade Metrics: Include digital exports and intellectual property in trade balance calculations to reflect the true economic picture.

- Strengthen Digital Trade Agreements: Protect U.S. digital exports from tariffs and trade barriers through international agreements.

- Invest in Innovation: Prioritize next-generation technologies like AI, quantum computing, and renewable energy to sustain global leadership.

- Regulate Monopolistic Practices: Encourage ethical practices within Big Tech to maintain global trust while addressing antitrust concerns.

Breaking Down the Barriers

The narrative that the U.S. is “bleeding” economically due to its physical trade deficit fails to consider its dominance in the digital economy. U.S. technology companies generate revenues and exert influence that far exceed traditional trade metrics. By shifting the focus to its unparalleled strength in the internet economy, the U.S. can redefine its role as a global economic powerhouse.

Understanding this transformation is essential to moving beyond outdated metrics and embracing the full potential of the digital age.

Additional Resources

Here are some insightful resources for further exploration of the U.S. trade deficit and digital economy dominance:

- U.S. Trade Deficit Data (2022) – Explore detailed statistics on America’s trade imbalance in goods.

Visit: U.S. Census Bureau – Trade Data - Big Tech Revenues and Global Influence – Learn about how companies like Apple, Google, and Microsoft dominate the global economy.

Visit: Statista – Global Big Tech Revenue Analysis - Digital Exports and Economic Contributions – Understand how the U.S. leads in digital exports, offsetting traditional deficits.

Read: McKinsey Report – Digital Trade in the U.S. Economy - Environmental Benefits of the Digital Economy – Explore how cloud computing and digital innovation reduce carbon footprints.

Learn More: Google Sustainability Insights - Antitrust Cases and Big Tech Monopolies – Discover the challenges U.S. tech companies face in global regulatory landscapes.

Visit: The Verge – Big Tech Antitrust Issues - Economic Policies and Global Dependencies – Examine how U.S. tech influences global trade and infrastructure.

Read: Brookings Institution – U.S. Digital Economy and Policy - U.S. Cloud Dominance – Analyze the impact of U.S. companies like AWS and Azure on global cloud computing markets.

Visit: Gartner – Cloud Market Share Analysis - Tech Innovations Driving the Economy – Review how advancements in AI, blockchain, and quantum computing position the U.S. as a leader.

Read: MIT Technology Review – Future of U.S. Innovation

These resources provide a comprehensive view of the U.S. economy, highlighting its challenges and strengths in the digital age.

Must Read : Nationalism in a Globalized Era